NEW SUBSCRIBERS PLS READ THIS: Given the interest in Gold and the new subscribers (thank you), some context is in order today. There will be two reports analyzed today after this. First, Hartnett’s Flow Show. Second, the promised breakdown of JPM’s must read $4,000 Gold report excerpted and sent to Founders last week. GoldFix presents proprietary analysis and commentary on markets. It also breaks down Wall Street’s better work on Gold, Geopolitics, and Macro so that subscribers can get more and better use of bank analysis. On significant reports like this one from JPM, a contextual third order analysis is necessary. This is that 3rd order analysis up front.

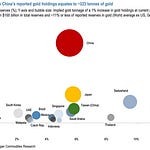

The JPMorgan Report is a Major Signpost in this Part of Gold’s Bull Run. Right or wrong, it is must read. Here is an explanation of why interspersed with some key JPM graphics making our case for us.

JPMorgan’s Quantification of Gold: A Structural Shift in Analysis

Comment: Gold is ground zero for a nascent Global Financial Earthquake and Banks are adjusting analysis in every asset class because of it

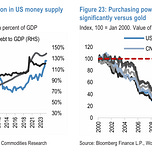

We begin with a straightforward framing of the situation: gold is no longer behaving as an asset primarily driven by movements in the dollar or interest rates. Western banks have recognized this shift and, accordingly, have adjusted their methodologies for analyzing and valuing gold.