Housekeeping: Good Morning. **Full report breakdown and analysis for Premium subscribers later this week**

Today

Discussion: JP Morgan Joins $4,000 Gold Club

Discussion2: Market Risks

News and Analysis:

JPM: $4,000 is coming: the How and Why

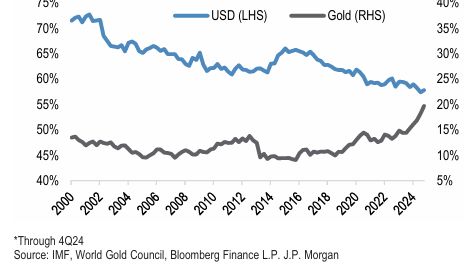

JP Morgan has officially added its name to the growing list of institutions forecasting a dramatic repricing in gold. According to the bank’s latest note, gold is set to cross the $4,000 per ounce threshold by the second quarter of 2026. Their base case sees a rise to an average of $3,675/oz by Q4 2025, followed by continued upside momentum. But it is not just the level that matters—it's the path, the pace, and the drivers that make this forecast notable.

In late March we examined the structural shift in gold’s demand and geopolitically-influenced pricing drivers ultimately asking if $4,000/oz was in the cards. After the upheaval of the first three weeks of April, our answer is yes.

Silver, often treated as a leveraged play on gold or a bet on industrial recovery, is expected to underperform in the near term. JP Morgan cites industrial demand uncertainty as a headwind through early 2025. However, the bank expects a “catch-up window” to open in the second half of the year, pushing silver toward $39/oz by year-end.

This implies a two-speed market: gold repricing for regime change, silver still trading on cyclical cues.

Full story in JP Morgan Joins $4,000 Gold Club

**Full report breakdown and analysis for Premium subscribers later this week**

Featured:

Markets Recap:

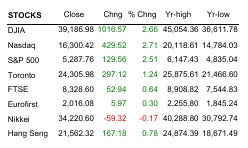

Stocks ended higher as strong earnings overshadowed tariff worries and Trump’s Fed criticism, while the dollar rose following Treasury Secretary Bessent’s comments hinting at easing US-China trade tensions. Long-term Treasury yields dipped amid mixed safe-haven demand. Gold pulled back after crossing $3,500. Oil prices gained, lifted by new Iran sanctions and an equities rally.

Canada's main stock index ended higher, as investors took a breather after the previous session's decline that was triggered by U.S. President Donald Trump's recent attacks on Federal Reserve Chair Jerome Powell. The Toronto Stock Exchange's S&P/ TSX Composite Index ended up 1.24% at 24,305.98 points.

Market News:

Barrick Gold sells Alaska mine stake to John Paulson, NovaGold for up to $1.1 billion

OpenAI would buy Google's Chrome, exec testifies at trial

3M beats first-quarter estimates, flags potential tariff hit on 2025 profit

Data on Deck:

MONDAY, APRIL 21 10:00 am U.S. leading economic indicators March -0.3%

TUESDAY, APRIL 22 9:30 am Philadelphia Fed President Harker speaks

WEDNESDAY, APRIL 23 S&P flash U.S. services PMI

THURSDAY, APRIL 24 Core durable orders (business investment) March

FRIDAY, APRIL 25 10:00 am Consumer sentiment (final) April 50.81

Summary and Final Market Check