Housekeeping: This is an announcing piece. it is the most comprehensive report todate. Even if it’s short term timing is concerning

**Full report breakdown and analysis for Premium subscribers later this week**

The $4,000 Signal

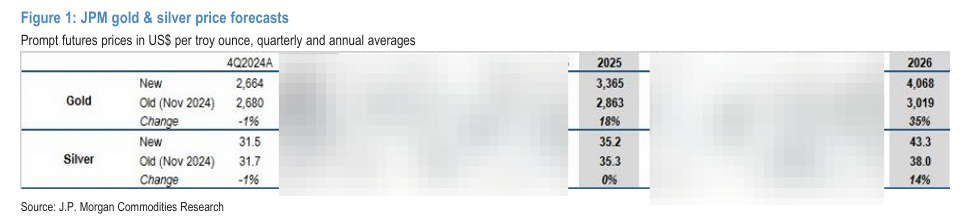

As of April 22nd, JP Morgan has officially added its name to the growing list of institutions forecasting a dramatic repricing in gold. According to the bank’s latest note, gold is set to cross the $4,000 per ounce threshold by the second quarter of 2026. Their base case sees a rise to an average of $3,675/oz by Q4 2025, followed by continued upside momentum. But it is not just the level that matters—it's the path, the pace, and the drivers that make this forecast notable.

GS: $3,300 → $3,700 (March '25)

JPM: $3,675 → $4,000+ (April '26)

Tail: $4,500 (GS)

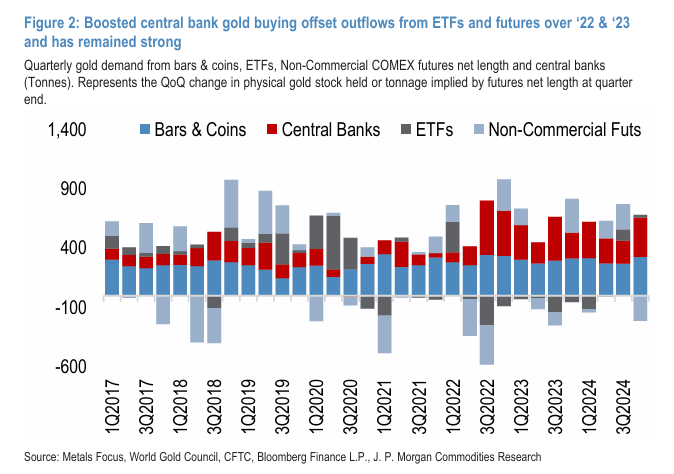

Core Drivers: Central Bank Appetite and Systemic Risk

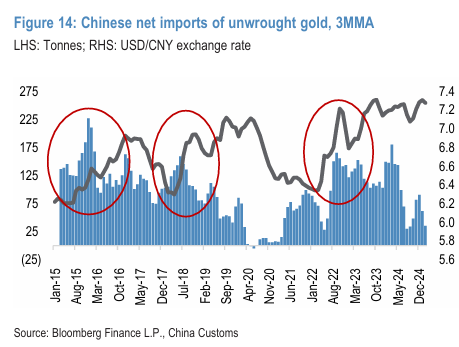

The key pillar in JP Morgan’s outlook is sustained central bank and investor demand. According to the bank, the gold market is expected to absorb 710 tonnes per quarter on net from these entities throughout 2025. This figure is not speculative; it reflects the continuation of a multi-year realignment of reserve assets at the sovereign level.

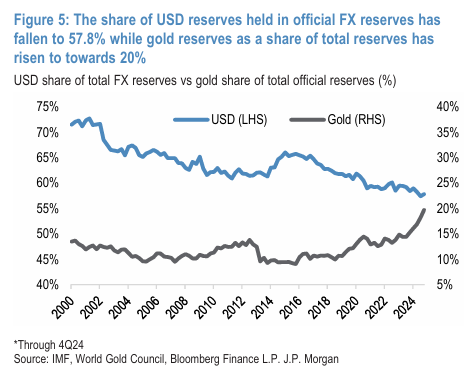

In the backdrop: heightened recession probabilities, renewed U.S. tariff escalation, and the grinding reconfiguration of global trade architecture led by the U.S.-China rift. Each of these forces feeds into a core narrative long understood by gold investors: gold as geopolitical hedge and monetary insurance.

This is not just about inflation. It's about systemic uncertainty, capital mobility constraints, and an increasingly fragmented global financial system. As such, gold is being repriced not on transitory price shocks but on structural fracture.

Risk Skew: To the Upside

JP Morgan emphasizes that the risks to their forecast are skewed to the upside. That is, a breakout to $4,000/oz could occur earlier than Q2 2026 if demand dynamics intensify—particularly if monetary or geopolitical conditions deteriorate faster than expected.

Gold is no longer reacting to macro inputs. It is, once again, leading them. The metal’s year-to-date rally of 29%, including 28 record highs, illustrates not just investor sentiment, but the failure of traditional safe havens to account for today's policy dislocations.

Goldman Sachs, notably, already raised its forecast to $3,700/oz by end-2025, and in “extreme tail scenarios,” sees $4,500/oz as plausible. The consensus is solidifying not around price alone, but around why prices are rising.

The Bear Case: Not Gone, But Fading

JP Morgan does acknowledge potential downside risks, with one central point of vulnerability: a drop-off in central bank demand. If geopolitical tensions ease or reserve management strategies pivot away from gold accumulation, the floor under the market weakens.

A secondary bearish narrative centers on U.S. growth resilience. Should the U.S. economy absorb tariff shocks better than expected, allowing the Federal Reserve to resume tightening policy proactively, the gold thesis could stall. But this is increasingly an outlier scenario—dependent on inflationary pressures staying dormant despite fiscal expansion and realignment stress.

Silver: The Lagging Indicator

Silver, often treated as a leveraged play on gold or a bet on industrial recovery, is expected to underperform in the near term. JP Morgan cites industrial demand uncertainty as a headwind through early 2025. However, the bank expects a “catch-up window” to open in the second half of the year, pushing silver toward $39/oz by year-end.

This implies a two-speed market: gold repricing for regime change, silver still trading on cyclical cues.

Conclusion: Strategic Accumulation Phase Confirmed

JP Morgan’s call for $4,000 gold by mid-2026 is part of a broader institutional migration toward viewing gold not just as a crisis hedge, but as a core asset in an unstable monetary environment. That gold hit $3,500/oz this week without a specific news catalyst underscores what this market already knows: gold is pricing in the structural—not the cyclical.

Central banks are preparing for fracture. The $4,000 price target is no longer speculative to JPM. It is a waypoint on a larger monetary revaluation map.

Gold is money and everything else is credit.