Housekeeping: Good Morning. We’ve unlocked the premium portion of today’s video..

“The goals (of Trump) will remain unchanged, the routes will have to be adjusted.”

Today

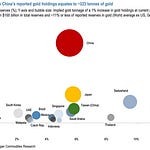

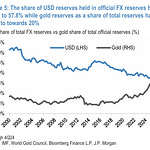

Discussion: China's Strategic Shift

Premium: Gold’s Logical Destination

Analysis: China's Strategic Shift

*CHINA:NO LONGER MAKES ECONOMIC SENSE IF US IMPOSES MORE TARIFFS

*CHINA TO LAUNCH 200 BILLION YUAN PLAN TO SUPPORT EXPORT-TO-DOMESTIC SALES TRANSITION.

*EXPANDS SERVICE SECTOR OPENING-UP PILOT TO 9 MORE CITIES, INCLUDING

*CHINA STOCK EXCHANGES SET DAILY RESTRICTIONS ON NET SHARE SALES BY INDIVIDUAL HEDGE FUNDS AND BIG RETAIL INVESTORS,

*CHANGES STATUS OF US CHIPS TO PERMIT THEIR IMPORTIn a statement, the commission declared that China would “no longer respond” to any further tariff increases by the United States. This signals a clear tactical shift. While the tariff war has escalated to historic levels, Beijing now appears to be capping its tariff retaliation and turning to non-tariff tools.

Beijing's position was firm. “Given that at the current tariff level, there is no market acceptance for U.S. goods exported to China. If the U.S. continues to impose tariffs on Chinese goods exported to the U.S., China will ignore it,” said the Tariff Commission.

“The escalation phase of the bilateral tariff war is effectively over,” said Zhiwei Zhang, president and chief economist at Pinpoint Asset Management. “Both China and the U.S. have sent clear messages. There is no point in raising tariffs further.”

Full Breaking story here…

Featured:

Markets Recap:

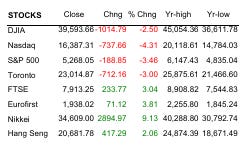

Stocks ended lower as investors fretted over the economic impact of the ongoing tariff war. Shorter-dated Treasury yields dipped after strong bond auctions eased demand concerns. Gold gained, supported by a weaker dollar. Oil fell as focus shifted to the intensifying trade tussle between the U.S. & China.

Canada's main stock index fell, in broad-based declines, coming off the previous session's rally spurred by U.S. President Donald Trump's temporary tariff relief. The Toronto Stock Exchange's S&P/ TSX composite index closed 3% down at 23,014.87.

Full market recap at bottom…

Market News:

US stocks sag amid escalating trade war with China

US off-price chains poised to win as tariffs play to strengths in sourcing, inventory

EXCLUSIVE-Chinese sellers on Amazon to hike prices or exit US as tariffs soar

Apple airlifts 600 tons of iPhones from India 'to beat' Trump tariffs

Full stories at bottom…

Data on Deck: PPI

MONDAY, APRIL 7 Consumer credit

TUESDAY, APRIL 8 NFIB optimism index

WEDNESDAY, APRIL Minutes of Fed's March FOMC meeting

THURSDAY, APRIL 10 CPI Monthly U.S. federal budget

FRIDAY, APRIL 11 PPI year over year3.3%1

Summary and Final Market Check…