Midweek Macro Note 10/15: Moral Hazard Markets, Powell Dovish Capitulation, Technical Softies, Nixonization

In this Midweek Macro Note, we discuss everything from the price floor discussion today, to the moral hazards finding themselves in equity markets, Powell's important QT comment, technicals, and more.

(@DonMiami3, MacroEdge Chief Economist)

Good Wednesday evening MacroEdge Readers and Community,

Hopefully you are all reading this note in great health and having a great week. Today was scheduled to be an inflation data release day and report, but as we are all well aware, the government shutdown continues to mean no government data releases for the time being. Price pressures have remained mixed, with signals from the real estate sector coming in cooler than expected, with home prices and rent prices dipping in majority of metros - while food prices and metals soar - and oil continues to dip. The complex picture is just a minor part of what’s made up the macro landscape now for the last 2 years, with crosscurrents in every direction, though not completely clouding a forecast of the future.

For the remainder of the week, we continue to trickle through some major earnings (like TSM and American Express), but things will stay considerably quiet on the macro data side of things with the government shutdown forecasted now to last almost 40 days. The latest GOP-Senate led bill to fund the government continues to fail, and it doesn’t seem like either side is eager to break the impasse for the time being. The longer things go now, especially beyond the 22nd, things will start to get more painful for Americans needing to interact with the federal government - especially if there are broader impacts at the FAA/TSA/USPS, which may start to happen after a second missed paycheck.

We’re pushing the throttle on MacroEdge Ozone, and we’re aiming to hit a top 100 Substack name in our space by the end of November. You can join the Ozone movement & get access to all of our critical research, data, strategy, and more with Ozone access below for 7-days:

Topics for the Midweek Macro Note:

MacroEdge Radio Schedule

Institutional Research Dashboard now live

Moral Hazard Markets

Powell Dovish Capitulation

Technical Softies

Data Center Pushback

Redeye Macro Note Preview

MacroEdge Radio Schedule

10/17: Peruvian Bull - Creator of Dollar Endgame

10/24: JustDario, Founder - Synnax

10/31: Michael Green, Chief Strategist - Simplify Asset Management

11/7: Benn Eifert, CIO - QVR Advisors

Institutional Research Update

Institutional Research is chugging along, our designer has made fantastic strides with the dashboard, which is now fully operational. Data and enhancements will continue to be added over the month of October. The mobile interface is now operational for iPhone and Android, and the interface can be installed directly onto your homescreen

The Institutional Research client X/Twitter account can now be found @MacroEdgeIR

Portfolio Strategies are now updated daily, and as we get settled into the new interface, updates will become much more frequent. The next monthly Institutional Research report will be on the first Saturday in November, though all Ozone notes, portfolio strategy updates, and commentary, are also available to all Institutional Research

Dashboard previews:

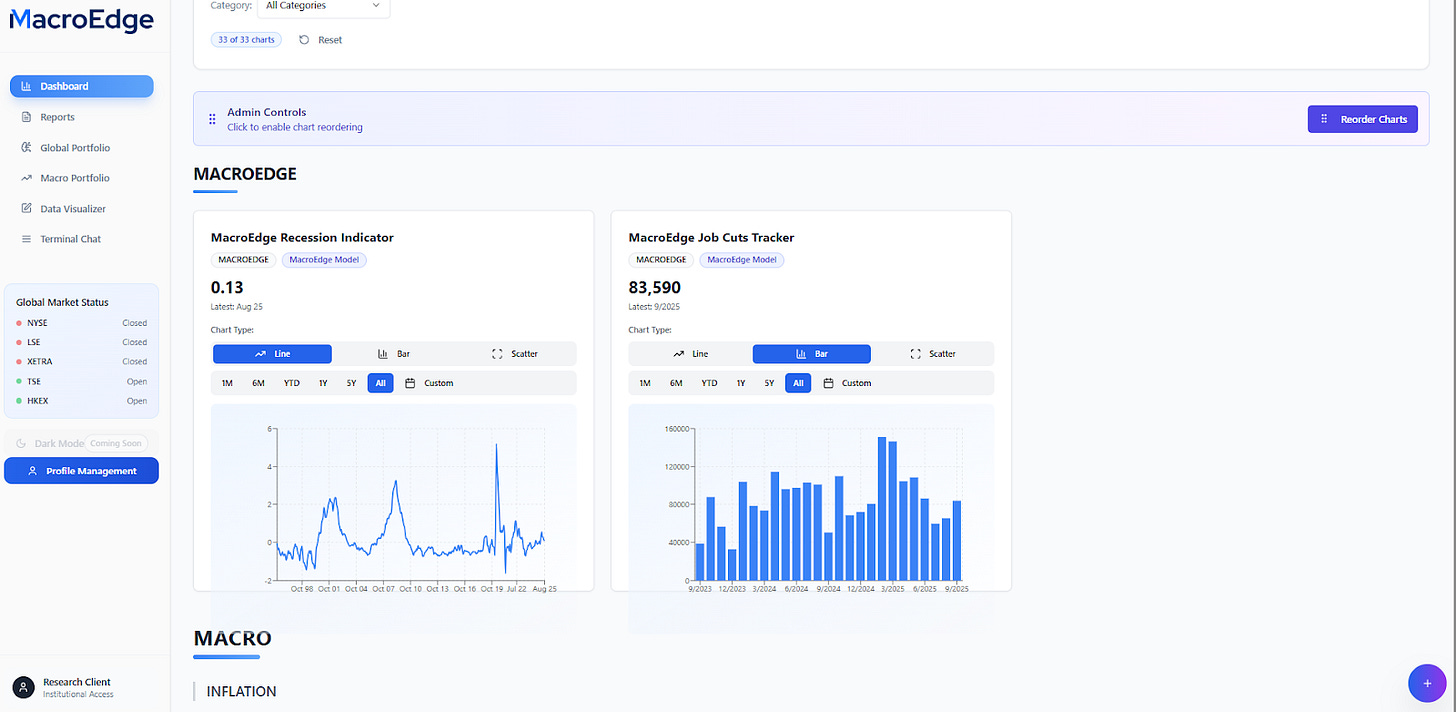

Over 50+ indicators live by the end of the month:

All reports are viewable and downloadable, within the dashboard:

The GMSP Portfolio Strategy & MIRP Portfolio Strategies are available under their respective pages, with all strategy updates, live holdings, commentary from strategy managers, & more. The data visualizer tool helps you visualize any macro dataset, and the Terminal Chat feature lets you chat with all MacroEdge team members & IR clients, completely anonymously.

The IR dashboard represents the foundation for something huge in 2026, and I can’t wait to see how it progresses through October & into the rest of 2025.

Registration for Institutional Research is now available – with 4 week trial access now available, through the button below:

Moral Hazard Markets

Since just Monday, Administration officials have directly discussed or mentioned the stock market over a dozen times. Between Scott Bessent, USTR Greer, the President himself, and other spox - this is a growing trend - with Chinese representatives noting that they’re using Trump’s fear of a minor equity market correction as leverage in the trade negotiations:

Shortly after this article was released, Bessent noted that the Administration isn’t at all worried about the stock market - which few of us should believe.

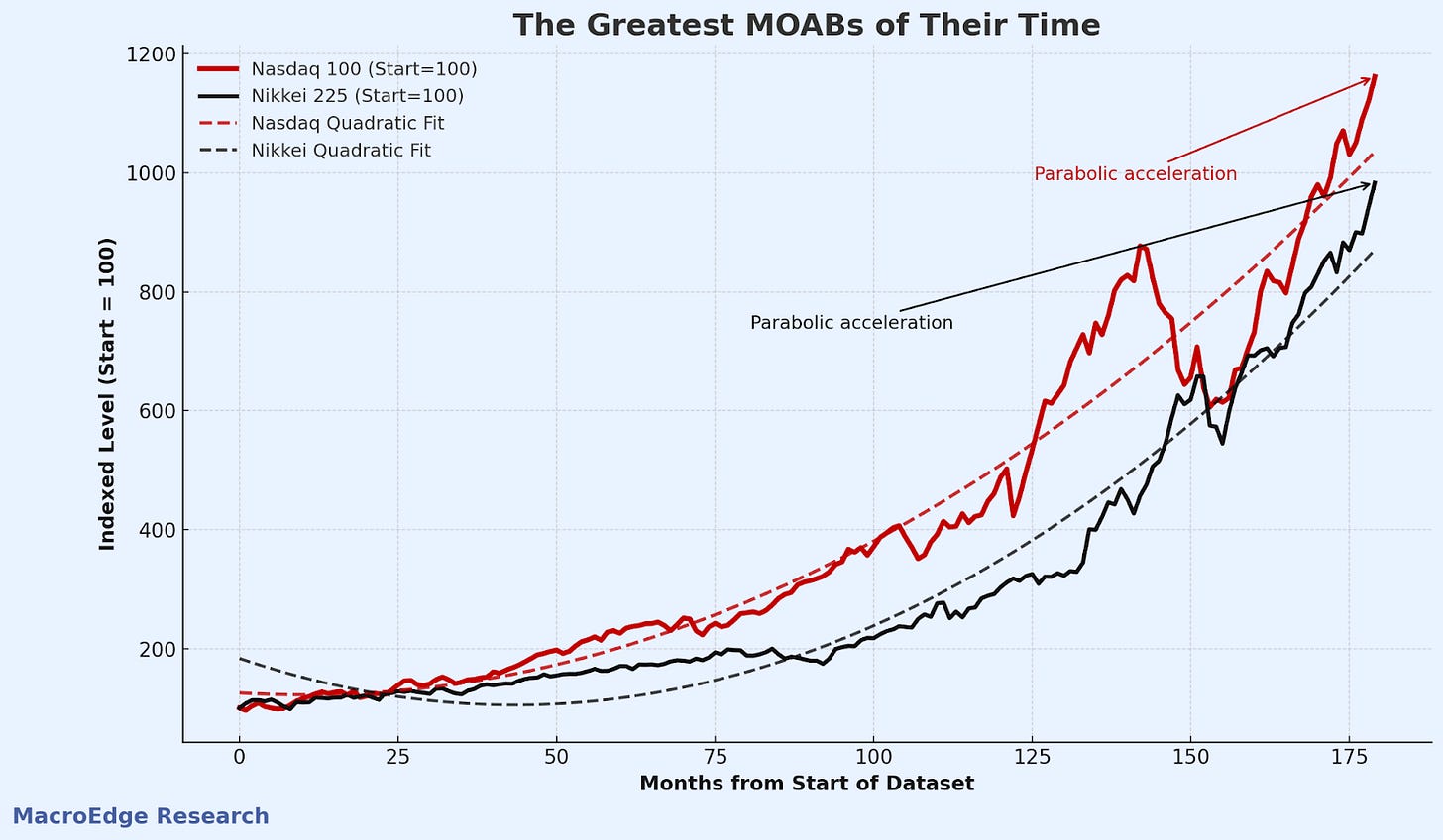

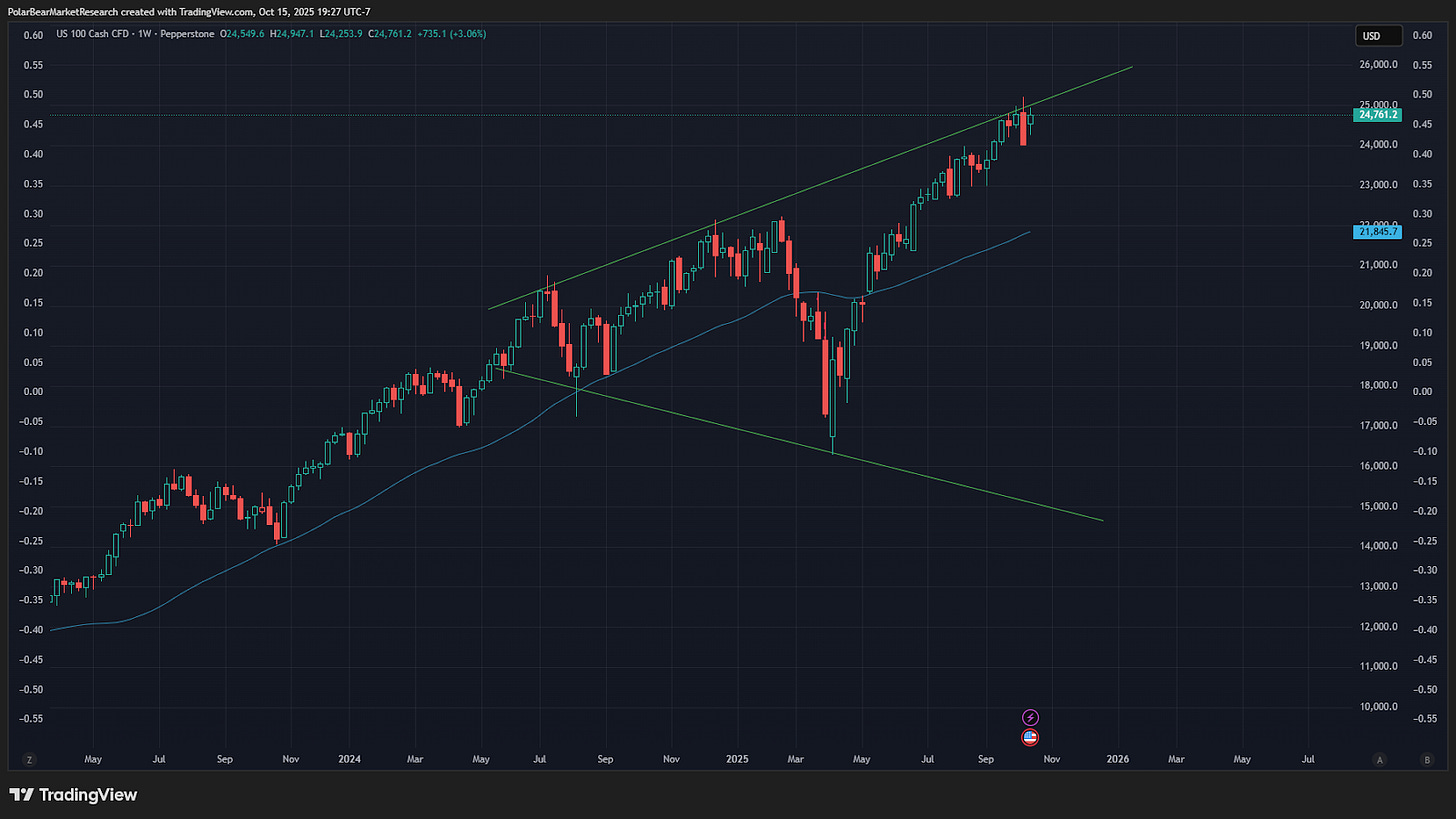

In a tweet earlier in the week on Monday, I noted that the fiscal arm of our government has blown the bubble so large that it’s a national security risk. They know this, which is why you see almost hourly discussions on market action, and rapid interventions from the ‘quasi’ PPT members as soon as the most minor drawdowns are experienced. The equity market today - particularly the tech-heavy Nasdaq - is now at its most extended level ever, with market cap concentration in the top 10 names hovering around 70% of total MC.

As we’ve discussed extensively from the April intervention bottoms that first sparked-off in Japan, this Administration is going to be the most active fiscal group we’ve ever seen in equity markets - thus far it’s holding very, very true.

There are four key reasons contributing to this moral hazard:

Markets Have Been Trained to Beg for Liquidity

The system has lost its discipline. Every pullback is met with rescue, every crisis with liquidity. What was once policy is now addiction. The market no longer fears risk because it no longer believes the government will ever allow pain.The Wealth Effect Has Become Political Survival

The administration knows that collapsing asset prices would detonate confidence across the country. The Nasdaq is the pulse of the top ten percent, and that ten percent drives spending, hiring, and sentiment. A major drawdown would heavily impact voter psychology.The Government Has Become Dependent on the Bubble

Tax receipts, pension valuations, and debt optics are all inflated by equity prices that live in utopia. The Treasury pretends these paper gains are real and builds policy around them. If the market corrects, the fiscal illusion ends instantly.AI is the Narrative Holding the System Together

The promise of artificial intelligence is now the final defense against reality. It justifies deficits and insane debt loads. It fuels valuations. It convinces investors and politicians alike that exponential growth will pay for exponential debt. If that story fails, the confidence that underpins the entire growth story that comes with it.

Powell Dovish Capitulation

Powell’s shift yesterday was calm on the surface but cautious underneath. The tone moved from firm to flexible, signaling that the Fed now sees enough cooling in the economy to justify a gentler stance. Markets welcomed it, but the reaction in gold and silver showed something deeper as investors questioned whether the Fed’s conviction on inflation is fading. The pivot was not panic, but it was pragmatic, and it raised new questions about how long the Fed can balance easing financial pressure without reigniting price risk.

Gold and silver moved sharply higher as investors interpreted the change as a return to easier policy rather than a sign of strength.

The bond market treated the move as confirmation that the tightening cycle is over, pushing yields lower across the curve.

The larger implication is that the Fed has shifted from fighting inflation to managing stability, hoping the transition looks deliberate and not reactive.

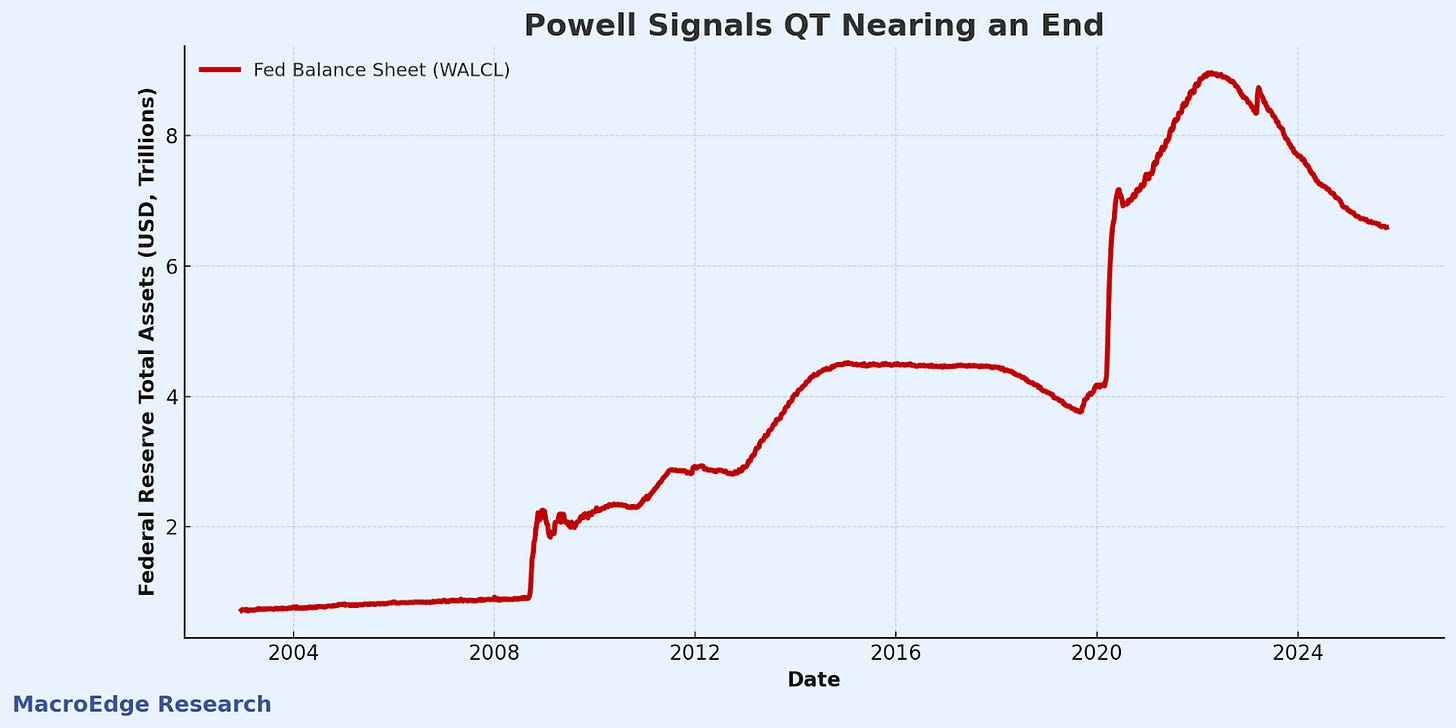

The biggest point and takeaway was Powell’s indication that quantitative tightening (QT) is coming to an end…

Discount window signals:

Technical Softies

No need for the left tail crowd to worry for NQ, as it appears distribution is underway:

Watch for weakness in bubble leaders, over the next 4-8 weeks:

Keep reading with a 7-day free trial

Subscribe to MacroEdge to keep reading this post and get 7 days of free access to the full post archives.